Under the Pradhan Mantri Awas Yojana, there is a Credit Linked Subsidy Scheme, which is a component designed to offer an interest subsidy on home loans for eligible applicants. With the CLSS subsidy, a home buyer can take care of purchasing, construction and home improvement needs.

- PMAY subsidy scheme is extended for the economically weaker, lower- and middle-income groups of the society. To be eligible for this subsidy, the government considers a family’s overall income and not just the applicant’s income.

- PMAY aims to provide permanent housing for all eligible applicants by 2022.

- Applicants can avail of an interest subsidy of 6.5% for up to 20 years, and the loan amount is based on the income group classification.

- Eligible applicants of this subsidy can use this benefit to either purchase a new home from a builder, construct one or upgrade to a pucca house if they correctly live in a kaccha house.

The PMAY CLSS subsidy makes the home loan process less expensive and taxing on the eligible applicants with its affordable housing facility.

How to Track the PMAY Status for Assessment?

On the government site, you simply need to visit the PMAY page and click on the ‘Track Assessment Status’ where you can choose to track by providing your name, father’s name and mobile number or input the assessment ID to track PMAY status.

How Long does it take to get a PMAY CLSS Subsidy?

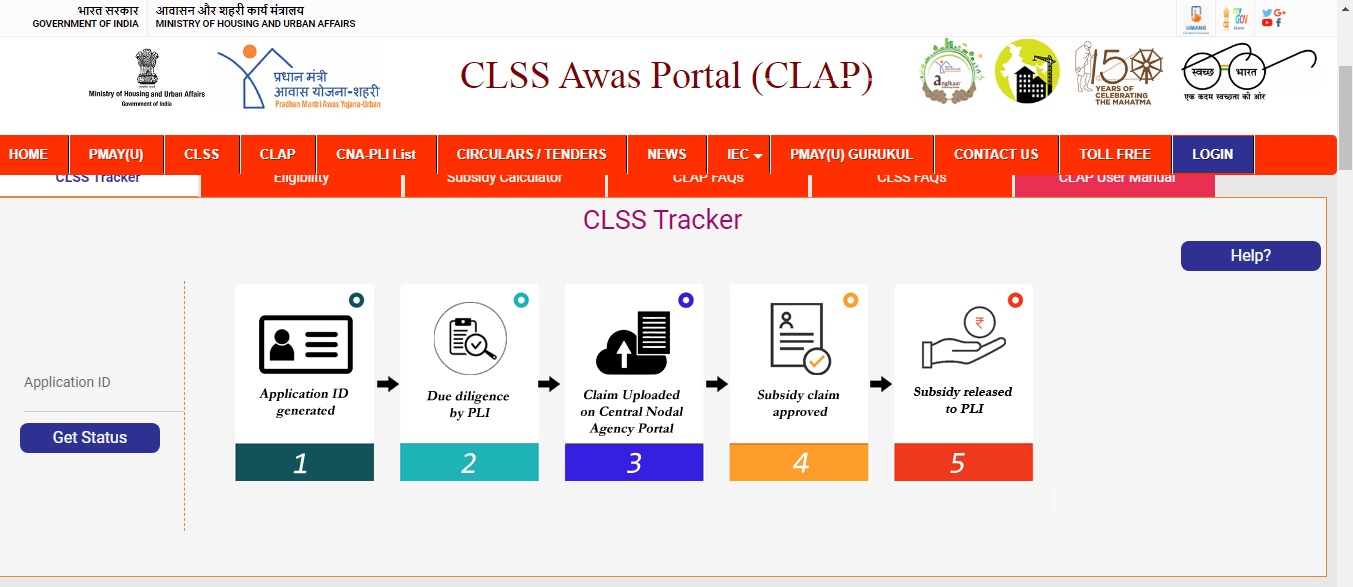

Once you have shared all your details with the government, you need to wait until they are verified. Only after your documents are thoroughly verified will your subsidy be published. It is safe to assume a waiting period of 3-4 months for the Pradhan Mantri Awas Yojana process. Here is how it works:

01. Two central nodal agencies, namely the Housing & Urban Development Corporation (HUDCO) and National Housing Bank (NHB), are in charge of paying the interest rate subsidy for the PMAY loans.

02. NHB approves the grant only of the deserving borrowers after doing a round of due diligence and data validation before initiating subsidy payment.

03. After applying for the PMAY Credit Linked Subsidy Scheme, the borrower will receive an application ID that will help track the PMAY status. From submitting the PMAY home loan application to the bank or a lending institution to getting the subsidy release, the application ID will play an essential role in controlling the subsidy status and process.

04. Once you receive the subsidy into your home loan account, it is advisable to verify it in your loan account statement to be thorough.

05. After the PMAY CLSS subsidy hits your account, the EMI amount will also decrease drastically.

Conclusion

PMAY CLSS subsidy helps increase the institutional credit flow by intervening on the demand side to help the lower- and middle-income groups buy a home. With the introduction of this subsidy, more and more people have been able to realise their dream and avail affordable housing in India.