If making a profit isn’t the primary reason, it must be one of the reasons many people go into business. The real estate investment world is one that many people didn’t understand until recently. Fortunately, many Americans are starting to discover how lucrative it is to invest in real estate.

But until recently, the concern of many people was how they could enter into an investment world exclusive to multi-millionaires. Many thought real estate investments were exclusive to multi-millionaires because they didn’t know there were ways to invest little funds in real estate.

Interestingly, most Americans today are into real estate and earning some extra cash in one way or another. One of the popular ways many people invest in real estate is through investment properties such as rental homes and vacation rentals, which has skyrocketed the property rental business.

People often purchase investment properties with the primary intent of making money through rental income, and some buy to sell for a profit after a short period.

Regardless of your intention, if you have added or you’re looking to add a real estate property to your investment portfolio, you’ll want to know how to calculate the return on investment on such a property. The ROI on the property helps you to determine the profitability of your investment.

What’s the essence of running a business if you don’t know whether you’re making a profit or not? That’s one of the reasons you’ll want to know how to calculate ROI on investment property.

The return on your investment property shows how much money you’ll make as a percentage of the property’s cost. And here’s all you need to know on how to calculate real estate return on investment:

What is Return on Investment (ROI)?

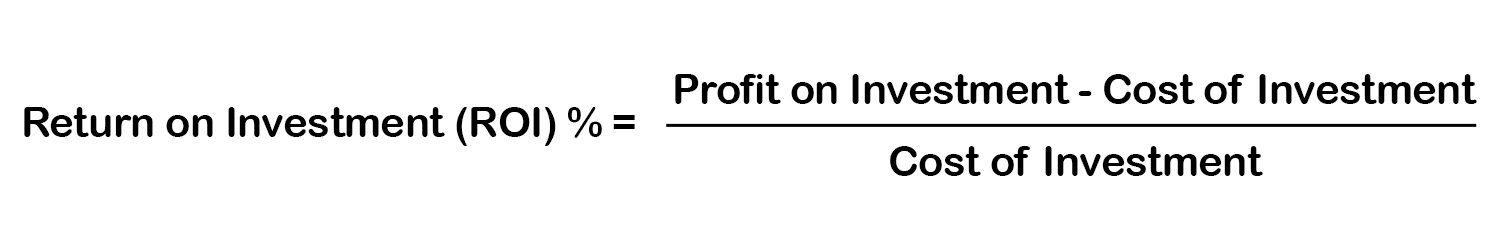

Return on investment estimates how much profit is attainable on investment as a percentage of the cost of such an investment. It’s one of the effective ways to see how investment funds generate profits. In a word, the ROI calculation process allows you to see whether investing in a particular property is a wise decision.

You can calculate return on real estate investment for virtually any form of investment ranging from stocks and bonds to real estate properties. However, calculating a meaningful and feasible ROI for a housing property can be challenging due to the easy manipulation of results through adding or removing certain variables.

And the calculations can get even complex when the investor takes a housing loan to finance the property or pay cash.

How to Calculate ROI on Investment Property?- The ROI Formula

To determine your profit on an investment, subtract the original cost of the investment property from the total return on such investment.

But you’ll have to go a little further to get the percentage ROI. You can determine the percentage ROI by dividing the net profit on the investment by the investment cost.

For instance, if you buy XYZ stock for $500 and sell it for $900 eighteen months later, your net profit is $400. Going by the ROI percentage formula, your ROI on the XYZ stock is 80 percent.

How to Determine ROI on Rental Properties?

Investing in a property can be thrilling, but you’ll want to carefully analyze the deal to ensure it is solid. Besides calculating the ROI on a property, it’d be best if you considered using a real estate investment calculator to determine the cap rate, main operating ratios, and cash flow for a rental property.

The above ROI formula seems simple enough, but remember that some variables affect the ROI of a piece of real estate. These variables include repair costs and maintenance expenses. And yes, financing conditions can significantly affect the total cost of the investment.

ROI for Cash Transactions

If you buy a piece of real estate with cash, calculating the property’s ROI is straightforward. Here’s a simple analogy:

- You paid $150,000 for a rental property

- The closing cost was $1,500, and remodeling set you back $13,500, bringing your total investment in the property to $165,000

- You charge $1,500 for rent every month

One year later:

- You earned $18,000 in rental income for one year

- Expenses covering insurance, property taxes, and water bills totaled $3,600 for the year or $300 monthly

- Your annual return now comes down to $14,400 ($18,000 – $3,600)

To calculate the ROI on the property:

- Divide the annual profit ($14,400) by the cost of the investment property ($165,000)

- Using the ROI formula, your ROI on the property was 8.73 percent

ROI for Financed Transactions

Say you bought the same $150,000 investment property, but you took out a mortgage instead of paying cash. Here’s how to calculate return on investment for the property:

- The down payment required for the mortgage was 20% of the purchase price. That’s $30,000

- Closing costs were higher – which is typical for a mortgage – totaling $3,750 upfront

- Remodeling set you back $13,500

- Your total expenses add up to $47,250

Meanwhile, there are ongoing costs for a mortgage. Say you took out a 30-year loan with a fixed interest rate pegged at 4 percent. The monthly principal and interest payment would be $737. Adding the $300 monthly bill payments, your total payments in a month is now $1,037.

Rental income is $1,500 per month, and it totals $18,000 per year. So, when you deduct your total monthly payments from the rent, your monthly income is $463. Your annual income amounts to $5,556.

To get the property ROI for a financed transaction, divide the annual gain by the total expenses on the property ($5,556 / $47,250). Your ROI is 11.8 percent. From the two payment options explained, you’ll agree that knowing how to calculate ROI on an investment property is beneficial.

So, What’s the Importance of ROI in Real Estate?

Knowing the ROI for any investment – especially a rental property – keeps you more informed and helps you make better decisions. Before you make payment, you’ll want to analyze some estimates like the costs and expenses, as well as your rental income. The results from your assessments allow you to compare with other properties.

Once you’ve narrowed your options, you can then choose a property that best fits your expectations profit and expense-wise.

The Bottom Line

The ROI for a rental property differs from that of other investments. And remember that the profit margins vary depending on whether you purchase the property in cash or finance it via a mortgage.

However, the less cash paid upfront on the property, the larger the mortgage balance and the greater the ROI. So, it’ll be a plus if you know how to calculate ROI on an investment property. Consider getting more information on rental properties from this article at TheShortTermShop.com.

You may also like to read the following article: