Food! Clothes! Home! These are the basic requirements for the human species to survive and thrive. Money is the means to acquire these three basic requirements. In the case of food and clothes, it is easy to just pack all of it and move to any place of your choice. And! Money can be transferred in the nick of time at our fingertips. How does one move the immovable properties, i.e. homes? Well! A moveable accommodation called Camper Van would have it sorted for all? ALL? Definitely not a logical idea for everyone! So, renting a place comes in as an executable option in such situations. According to the Housing Census of India, only 11% of total houses were rented in 2011, which nearly tripled to 30% by 2020. And, it’s only likely to see an upper spike as the population keeps relocating for better opportunities. But how much income to spend on rent? How much can i afford for rent?

House Rents and Myth’s?

Interesting conversations keep popping up every time one starts a house hunt. One of the most discussed topics is income to spend on house rent itself. House rent holds an explicit position in the housing budget rent for a month. Every individual looking for renting a house wonders how much of his income will go paying off the rent.

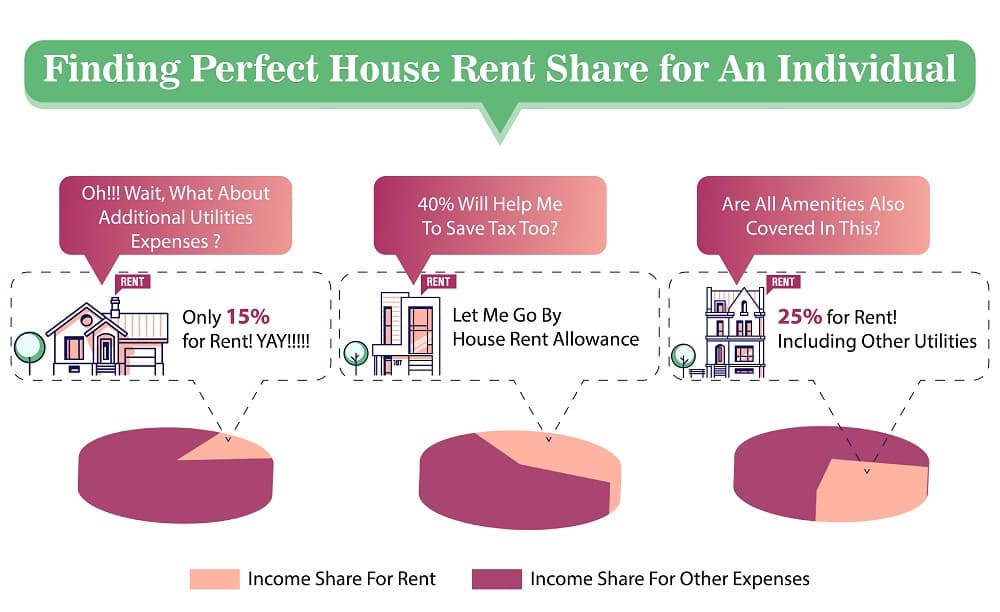

In America the landlord keeps a check that salary is three times the rent just to make sure that his rent will be paid. Some even feel that 30% or 25% of monthly wage is enough to be spared for rentals? Or should it be just 20% of income? What percentage of salary on rent? No matter what percentage of your salary you spend, it’s a well-known fact that paying rent is usually a significant expense. It’s not uncommon for renters to struggle to make ends meet. Of course, if unexpected expenses or a change in circumstances make it difficult to pay on time, loans for paying rent can be a viable option. However, it’s much better to keep your rent within your budget. So let’s find out how to calculate the maximum rent payment you can afford.

Breaking the Rental Myth

This myth of 30% or 25% of salary for rental rule of thumb on rent which was debunked right in early 80’s by Researcher Hanna S. who investigated topic of ‘The Impact of High Rent Expenditures on other Consumer Expenditures.’ There is huge chunk of income spent on health care, education, travel etc. depending on family size and income. Especially for low income group when 25% or 30% is reserved for rents, very less money is left for other expenses. So even after four decades, should we still continue to shelve 30% rent rule for all income groups?

Or

Are we missing the aspects of income to spend on rent puzzle in better way?

Let’s have a brief look at all the possible facets that impact rental decisions.

Factors That Help to Make Informed Decision to Know How Much To Spend On Rent?

One of the significant factor is employment type.

Are rent share and employment co-related? Yes…Yes…Yes! They play a pivotal role in renting decisions. But how?

Let’s know about employment types.

Employment Types for Rental Shares

The above images tells us about different employment type.

Majority of full-time employees are already provided with a component of house rent allowance (HRA) in their pay package, while entrepreneurs, part-timers and contractual employees have to plan income to spend on rent depending on other factors.

Following points are only important if you are a Full time employee, skip it if you are not.

01. Rental Share for Full-time Employee

The employees are provided with the company’s accommodation or allowance. House Rent Allowance (HRA) is the allowance to compensate for the rent.

- The combination of Basic Salary, Dearness Allowance, HRA and other incentives is known as ‘Gross salary’. When the Gross salary is added with the cost of other benefits like Insurance, Food Coupons/Subsidized meals, etc., it is called CTC (Cost to Company).

HRA structures for Private and Government Employees are very Different

a) Government sector: The 7th pay commission classified the cities in 3 different categories. For major cities like Mumbai, Delhi, Chennai, Kolkata, Ahmedabad and Hyderabad covered under Class X, HRA is 27% of basic salary. While the Class Y includes other major city of different cities, here HRA is 18%. All the other cities not included under both these are under Class Z, here HRA is at 9%. The HRA % of rent affordability also changes with changes in pay commission.

b) Private sector: HRA can be a fixed amount or 50-40% of Basic salary. 50% of basic salary is considered for cities like Mumbai, Chennai, Delhi and Calcutta while 40% is for others. This is the most important guiding factor for private-sector employees to set upper limits on house rents.

Income Tax Deduction for House Rents

- HRA can also help you save some bounty from the Income Tax amount. As per Indian Income Tax law 2011, under section 80GG, there is Clause 13A with additional Section 10 the income under which rent payment is considered as a tax exemption. Exemption is considered on the least three from 3 option:

- House Rent Allowance (HRA)

- 50- 40% of basic salary

- Actual rent minus 10% of the annual wage on rent paid.

This value can only be exempted when receipt is presented.

But, wait a min! How does even taxable income matter in the case of share of income to spend on rent? Well, it’s mandatory to submit landlords PAN card details if the annual rent is above 1 lakhs. But, some landlords may not agree to abide by it, which will impact finalizing the rental amount.

02. Rental Share for Entrepreneurs, Part-Time and Contractual People

Let’s look at other factors that impact the rent decision of rental share for people who don’t have HRA allowance.

a. Affordability Dimension for House Rent

This is one of the most indispensable aspects. The World Bank has provided division of income group division indicating annual Gross National Income (GNI) in current USD. When total cumulative wealth of a country is divided by the total population of the current year GNI is found. India comes under lower income group, which portrays that there is a huge income disparity here. The graph shows that income groups slowly progresses.

Rent Proportion With Respect To Income Group

The conversion of 30% rent rule of income vs rent for every income group varies significantly. That is, for higher income group the 30% rent to income ratio would be proportionally higher compared to lower income group. For lower income group it would be a very small amount, making it difficult to find a suitable rental house. On the other side, it would be a very high income share to spend on rental amount for high income group. It has a complete possibility to disrupt the rental market if they decide to pay the large amount.

Long time Real Estate Researchers Gaurav W. and Karan S who studied income to rent affordability, pointed out that high income group is left with more surplus than middle and lower-income groups after paying rent. This implies that minimal portion is left for non-housing expenses.

For middle and lower-income group there are also other additional factors which are needed to be worked out to come to an amount that would allow them to arrive at a decent amount for rent affordability.

b. Family Structure & House Size Suitable for Rental

A single person can share a room or a house to save money. But, when a person moves with family, the house has to be big enough to accommodate all. Depending on family structure one needs to decide what would suit them from range of 1Bhk to whatever big is available in the market.

Size and rents of the house go hand in hand. When Researchers Abhiman D. et al. worked on the ‘Hedonic quality adjustments for Real Estate Prices’ in India some interesting results were found. They extrapolated that rent for a one-room and a two-room house done not differ a lot. While a three-room home has a significantly higher rent.

Amenities like an attached toilet to all the rooms could be more expensive. This could increase income share to spend on rent by 30 to 20 % on average.

c. Location of Rental House

Neighborhoods are chosen as per the age and sex of a person and their family structure. For a person with family a location near hospital and school as per family member composition would work better due to ease of access to these facilities. This will have visible impact on travel expenditure to the work place affecting rent affordability.

A single working women prefers to rent in more lively area filled with residential and other essential facilities which are always open. Rents of such places are on higher side so high income is spend on rent.

d. Family & Additional Expenses From Income

Additional non-housing expenses need to be calculated when a person has a family to be taken care of. These expenses depend on what constitutes their family, like kids and their age or parents or both. A Harvard study on measuring housing suggests additional costs like childcare, healthcare, disability and chronic diseases, education. More the people, more the expenses. How to budget for rent in such circumstances becomes critical. The rent affordability will be less than 30% of your income, if diverted to such expenses including the insurances.

e. Cost of Rental Furnishings

- Fully furnished houses increases the income amount to spend on rent come at a relatively higher rent. Rental costs can be reduced by opting for a semi-furnished or an unfurnished property. They could buy these furnishes or rent the furnishings from trustworthy portals.

- One time buy is an excellent option for someone who moves less and finds a comparatively cheaper place.

- If someone is into a profession that keeps them moving, then fully furnished or renting the furnishings would help save more bucks.

- Differently-abled people, the elderly and kids require specialized furnishing which has an additional cost attached to it.

f. Price for View of Houses

Economists ‘Stephen C. et al.’ probed into the study of co-relation of floor to rise in price. He derived that the rent increases as one moves towards the higher floor. These are cited as premium properties. There is an additional cost for apartment rentals based on income. There is an increase of around 10-2 % on the rent affordability for quality and experiential spaces. This factor is entirely dependent on the climate of the cities and corresponding view.

g. Utility Costs of Rentals

- There are bills to be paid when renting. There are other associated utilities like Broadband, Cable, Gas, Electricity, Water, Maintenance, Phone bills, Parking any other bills depending on the necessity and preferences. These bills can be paid monthly, quarterly and annually.

- Some rentals for a month are inclusive of these costs. Charges for amenities could increase income to spend on rent by 15% extra varying from city to city.

Along with the utilities there are certain rights reserved for tenants that should be kept in mind while signing the contract.

h. Income Stability

For some people, not all seasons are as rosy as one would like to believe. There could be instability in monthly income for specific people.

Economic Researchers John. Q et al. has researched the affordability of housing, discussing income instability. The least monthly income should be considered for rent affordability instead of the average annual income.

Considering the lowest income amount will help tread on a safer path as all the foreseeable risks should be considered and better expenditure planning.

i. Saving for Rent

Indian and Asian houses populations have bought the idea of savings. They believe in the idea so much so that from childhood their children are taught to save in piggy banks to promote savings.

Social scientists Lisa A. et al. studied approach to savings w.r.t lifestyle. It has a massive influence on savings, i.e., a lavish lifestyle with less income would have less to fewer savings. Savings can impact budget for renting.

It should be the norm to save the residual money from other expenditures, or a certain percentage should be left aside every month from the budget income to spend on rent.

This can come very handy when income gets reduced due to calamities or loses the job.

Savings can be planned as per renewal of rent agreement that happens every 11 months. Check out, why rent agreement is only for 11 months? to know more.

The Crux of the Story for Rent Share

As seen above, there is no fixed value of income to spend on rent that could suit all people. There many are many factors that affect the decision which vary person to person. We have enlisted summary of the points to ease your query of how much can i afford for rent?

- Employment type

- Affordability

- Family structure & house size

- Location of house

- Family & Additional Expenses

- Furnishings

- Price For View

- Utility costs

- Income stability

- Savings

Tenant must note down all the expenditures keeping his/her/their financial, physical and psychological condition in mind. Even future aspirations and responsibilities need to be considered. Then, a well-informed decision for the balancing act of expenses has to be made.

The Pros & Cons of Renting a House