Table of Contents

Quick Summary

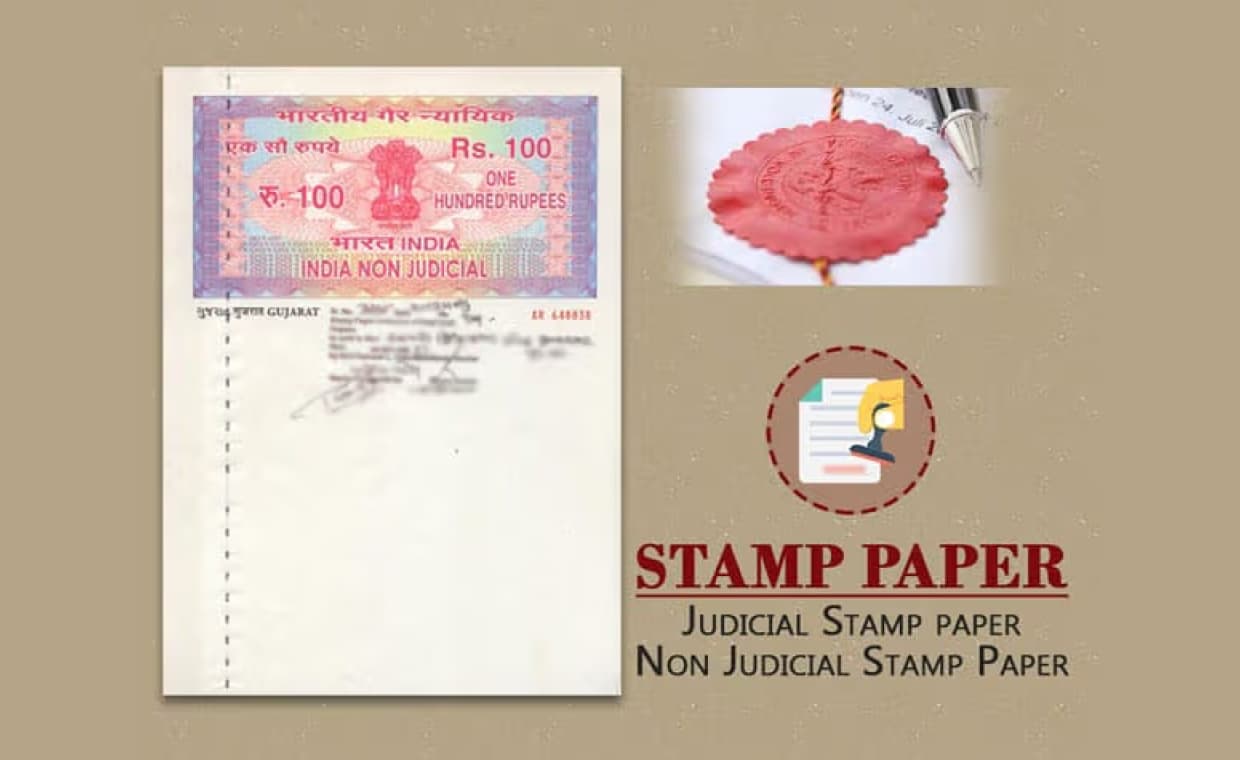

- Stamp papers are essential for making agreements, contracts, and property documents legally valid across India.

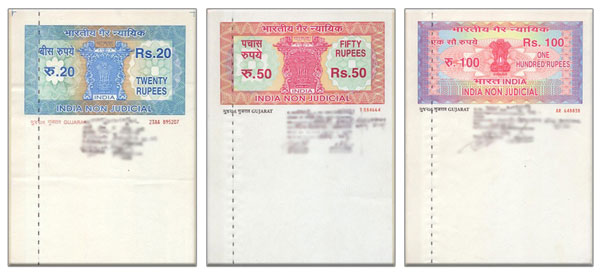

- Stamp paper is issued by the Government and carries a value of Rs.10, Rs.20, Rs.50,

- Rs.100, Rs.500 or more.

- Stamp paper is of two types: Judicial and Non-Judicial.

- Judicial stamp paper is used for court fees and legal processes.

- Non-judicial stamp paper is used for commercial, financial, or property-related transactions.

- Non-judicial stamp paper is widely used for documents like Power of Attorney, sale deeds, rent agreements, affidavits, transfer of immovable property such as buildings or land, loan security, mortgages, and other important agreements.

- Non-judicial stamp duty can be paid by buying stamp papers, through franking, or using adhesive stamps.

- However, e-stamping is the modern method for non-judicial stamp duty and is widely preferred.

- The validity of a non-judicial stamp paper is usually six months as per the Indian Stamp Act.

- The Gujarat Government encourages the use of digital stamping and has discontinued the use of physical stamp papers since 2019.

Stamp papers play a key role in all legal documents across India. Whether you are getting into a rent agreement, transfer of property, signing a business contract, or issuing a Power of Attorney, using the right stamp paper is mandatory to make the document legally valid. Stamp papers are judicial and non-judicial, among which non-judicial stamp paper is the most widely used.

In this guide, Gharpedia explains everything you must know about non-judicial stamp paper – its meaning, uses, values, price, how to buy it, validity, how it is different from judicial stamp paper, and the impact of e-stamping in states like Gujarat.

What is a Stamp Paper?

A stamp paper is a foolscap-size blank paper that’s printed with a revenue stamp like the one imprinted on currency notes or postal stamps. It is issued by the Government and usually carries a stamp paper value of Rs.10, Rs.20, Rs.50, Rs.100, Rs.500 or more.

Though every stamp paper carries a monetary value it can neither be treated as a negotiable instrument nor exchanged like currency notes. The document is used for endorsing authenticity to official agreements.

Whether you are documenting a daily business transaction or executing an agreement for an upcoming project, using a Stamp Paper is a must. Whatever’s the modus operandi of an agreement, if you want to add legal sanction to it, a stamp paper should be used.

Brief on Types of Stamp Papers

There are two types of stamp papers commonly used.

01. Judicial Stamp Paper

Generally, judicial stamp papers are used for legal purposes. For instance, it can be used for proceeding with court cases or continuing legal procedures. These stamp papers are also known as court fee stamp papers as they are often used to avoid cash transactions with the court. A case may not be admitted by the court without the payment of court fees. This makes judicial stamp paper important.

02. Non-Judicial Stamp Paper

Non-judicial stamp papers are generally used for documents like Power of Attorney, sale deed, rent agreement, affidavits, transfer of immovable property like building or land, loan security, and mortgage or other important agreements.

The stamps are used as per the rates determined by the government for recovery of the stamp duty. At present, you can use a non-judicial stamp paper of value Rs.5, Rs.10, Rs.20, Rs.50, Rs.100, Rs.500, Rs.1000, Rs.5000, Rs.10000, Rs.15000, Rs.20000, or Rs.25000 for the documents mentions above.

Stamp Duty is the tax levied on the legal acknowledgment of documents. According to the law, it is mandatory to pay stamp duty to the Central/State Government when certain transactions take place. The value of stamp duty is either fixed or it may vary with the value of property/instrument under question. All states have different laws and prescribe the amount of stamp duty to be paid for a particular transaction which will vary from one state to another. In India, for instance, the Indian Stamp Act, 1899, is applicable for states, which do not have their own Stamp Act.

When paying the stamp duty, remember to research the required amount to be paid for a certain transaction. Avoid buying a non-judicial stamp paper or stamps or applying for franking or E-stamping without ascertaining the leviable dues, failing which you may overpay or pay less and remain liable for a penalty.

Difference Between Judicial and Non-Judicial Stamp Paper

| Judicial Stamp Paper | Non-Judicial Stamp Paper | |

| Purpose | Used for court fees and legal proceedings | Used for agreements, contracts, property documents |

| Common Use | Petitions, appeals, court applications | Sale deed, rent agreement, affidavit, POA |

| Issued For | Payment of court fees | Payment of Stamp Duty |

| Also Called | Court Fee Stamp | Stamp Duty Stamp |

| Required For Registration? | No | Yes, depending on the document |

| Denominations Available | ₹50 to ₹25,000 and above | ₹5 to ₹25,000 |

How to Buy Non-Judicial Stamp Papers?

There are three legal ways of paying stamp duty or fulfilling the formality of buying stamp papers for paying scheduled stamp revenue. They are:

01. Buying Stamp Papers

- Traditional Stamp Papers

- E-Stamp Papers

02. Franking

03. Adhesive Stamps

In all these ways, you can pay stamp duty to the government to make a document legally enforceable.

The value of a stamp is to be used in the prescribed format under the instruction of law and will vary depending on the sale/deed value of the transaction. If you fail to pay attention to these details, the document may not remain enforceable. In other words, it will either become invalid or you may have to pay a penalty under the stamp act.

Details You May Need While Buying a Non-Judicial Stamp Paper

- First Party Name

- Second Party Name

- Addresses of both the parties

- Document Name

- Stamp Paper Value

Also Read: All You Know About Conveyance Deed for Your Property!

Methods of Buying Non-Judicial Stamp Paper with Details

01. Buying Process of Traditional Stamp Papers and E-Stamp Papers

The Stamp papers have to be purchased in the name of one of the parties involved in the contract/transaction. It is also advisable to buy traditional non-judicial stamp papers from Government-authorized stamp vendors.

These days, E-stamp papers are proving to be an effective alternative to the traditional stamp papers.

E-Stamping (Modern Method for Non-Judicial Stamp Duty)

E-stamping is a computer-based arrangement that offers a secure way of paying non-judicial stamp duty to the government. The electronic non-judicial stamp paper bears a unique Identification Number that authenticates every transaction done on these papers. The State Government of all states is introducing the facility of ‘E-Stamping’ through the Stock Holding Corporation of India Ltd. Mostly, this facility is available in all the districts and Block Head Quarters of the Sub-Registrar. Hence, the person going for registration of the document can opt for paying the duty at the site after which the E-stamping certificate is issued immediately.

Details You May Need While Buying a Non-Judicial Stamp Paper:

- First Party Name

- Second Party Name

- Addresses of both the parties

- Document Name

- Stamp Paper Value

Details Included on the E-Stamp Paper:

- Certificate no.

- Certificate issued date

- Account reference

- Unique Doc Reference

- Name of the E-stamp purchaser

- Description of document

- Description

- Consideration price

- Name of the First Party

- Name of the Second Party

- Name of the Stamp Duty Payer

- The value of stamp duty paid

02. Franking

Franking is a technique of printing a mark on a document indicating that the stamp duty for the transaction is already paid. Franking machines are installed in many Sub-Registrar offices. After the receipt of the stamp duty, the authorized officer franks the document and returns it to the applicant, authorizing the receipt of the money.

You may not have the availability of a franking facility nearby for validating your document because it is not widely available yet. However, you can always buy a traditional non-judicial stamp paper for remitting the stamp duty.

Moreover, if there is any demand for the same by the banks, special adhesive stamps franking licenses are available. These stamps have already earned huge popularity in the state of Gujarat and many others.

03. Adhesive Stamps

Adhesive stamps are convenient labels that can be pasted on documents as a sign that the stamp duty has already been paid. They are adhesive stamps like postal stamps but cannot be used on legal documents. Hence, avoid using them rampantly, unless you are sure about their acceptance.

The Easy Way to Get Stamp Papers

Non-judicial stamp papers can be purchased online. Vendors also can provide you stamp papers of the following valued in bulk.

Rs.1 | Rs.2 | Rs.5 | Rs.10 | Rs.20 | Rs.50 | Rs.100 | Rs.500 | Rs.1000 and Rs.5000.

Mistakes to Avoid While Buying Non-Judicial Stamp Paper

- Buying stamp paper without checking state-specific stamp duty

- Using judicial stamp paper for non-judicial documents

- Buying from unauthorized vendors

- Leaving the stamp paper unused for years without proper storage

- Using adhesive stamps where non-judicial stamp paper is mandatory

- Not verifying the UIN on e-stamp certificates

The Validity of the Stamp Paper

Section 54 of the Indian Stamp Act states that if you do not need a stamp paper bought by you, it can be deposited back to the Collector within six months from the date of purchase. In such cases, you will get a refund of the purchase value after deducting 10 percent of the amount.

In Thiruvengada Pillai Vs. Navaneethammal & Anr, it was held by the Hon’ble Supreme Court that a stamp paper, even if it is more than six months old, is valid for the use. Section 54 bars taking a refund after six months of purchase; however, it does not restrict the use of such old stamp paper for an agreement.

Thus, the stamp paper can be used even after it has crossed the stipulated validity period of its purchase.

As such, Indian law does not have any prescribed period of limitation for its validity. However, Maharashtra and Gujarat are the two states which have amended laws and now have law provisions stating that if a stamp is not used or surrendered within a time frame of six months from the date of issuing these papers, they will be treated as expired.

What to Do with an Old Stamp Paper (Non-Judicial)?

As stated above, you can always deposit back the purchased stamp paper within six months from the date of purchasing the stamp paper, provided it’s not be spoiled or rendered unfit.

In such a situation, you will have to satisfy the below-mentioned conditions :

- You have purchased them for use with a Bonafide intention.

- You have paid the full price of the stamp.

- The stamp paper was purchased within six months before the date of depositing.

- If you are a stamp vendor, you may get a 100% refund.

The Government of Gujarat Has Ended the Use of Physical Stamp Paper

In order to encourage the use of Digital stamping in lieu of non-judicial physical stamp papers, the Govt. of Gujarat has banned the use of physical stamp paper effective 1st October 2019.According to Govt. of Gujarat, this decision was made to promote the idea of ‘Digital India’ by our Hon’ble Prime Minister, Shri Narendra Modi.

Hence, all citizens will now have to use the facility of Digital stamping only. The facilities for e-stamping shall be available at all Scheduled banks and financial institutions under the control of State and Central Government, post offices, Licensee stamp vendors, Chartered Accountants, Company Secretaries, C&F agents of Ports, Common Service sectors under e-governance plan, non-banking financial companies registered under RBI, and Licensee notaries among others.

According to the Government, this decision will effectively tackle issues like the artificial scarcity of stamp papers and reduce the risk of people being cheated by stamp vendors. Payments for stamp duty can be made in cash, through RTGS or net banking, or using other online payment facilities. The Government intends to start e-stamping facility centers all across the states.

The Digital stamping facility generates a ‘unique certificate number’ that can be verified during the registration of documents by sub-registrar, making the process secure. Further, being online, the registration can be verified at any time. Besides, the process offers freedom from buying blank stamp papers in advance, averting the need for applying for a refund of a stamp.

To Sum Up

It is mandatory to use non-judicial stamp paper while you are legalizing an agreement, affidavits, and property documents legally enforceable in India. By using a stamp paper, your document will have legal validity and it can be enforced under the laws of the land. Depending upon the type of the document, you have to choose between judicial and non-judicial stamp paper. You also always have the option of buying traditional stamp paper or opting for the E-stamping or franking process. Either way, the correct stamp duty should be paid as per your state’s laws.

Also Read:

Is There any Provision If Tender gets Cancelled after its Allocation?

Lease or Rent: What to Choose when in Search of Shelter?

FAQs on Non-Judicial Stamp Paper

01. What is non-judicial stamp paper used for?

- Sale Deed of property

- Gift Deed

- Mortgage Deed

- Loan / Finance Agreement

- Lease / Rent Agreement

- Agreement to Sell

- Power of Attorney (POA)

- Affidavit

- Declaration / Undertaking

- Indemnity Bond

- Partnership Deed

- Transfer of immovable property

02. What is the purpose of non-judicial stamp paper?

- To give legal validity to an agreement.

- Make it admissible in court as evidence.

- Ensure the document is enforceable under law.

- Prevent disputes relating to fraud or non-payment of tax.

03. Why is e-stamping a safer option?

E-stamp has a Unique Identification Number (UIN) on every certificate and it is tamper-proof. Moreover, it can be accessed for real-time verification.

04. When should you not use non-judicial stamp paper?

Non-judicial stamp paper is not required for:

- Filing court petitions or applications

- Paying court fees

- Criminal proceedings

- Affixing revenue stamps on receipts

- Notary attestations (₹5 Notary Stamp is used instead)

05. Can I use a ₹100 stamp paper for any agreement?

Yes, you can use a ₹100 stamp paper for simple agreements and affidavits. But for property documents, stamp duty depends on the value of the stamping.