The stamp paper is a foolscap-size blank paper that’s printed with a revenue stamp like the one imprinted on currency notes or postal stamps. It is issued by the Government and usually carries a stamp paper value of Rs.10, Rs.20, Rs.50, Rs.100, Rs.500 or more.Though every stamp paper carries a monetary value it can neither be treated as a negotiable instrument nor exchanged like currency notes.

The document is used for endorsing authenticity to official agreements. Documents with legal implications, such as Lease Agreement, Buying and Selling of Property, Business / Contract Agreements, Loan Agreements / Financial Deals, Power of Attorney, Affidavits, Articles of Association, Memorandum of Association, Indemnity Bond, Declaration, Mortgage, and Gift Deed among others are executed on stamp papers to make them legitimate and legally enforceable.

Whether you are documenting a daily business transaction or executing an agreement for an upcoming project, using a Stamp Paper is a must. Whatever’s the modus operandi of an agreement, if you want to add legal sanction to it, a stamp paper should be used. In this blog, we have discussed difference between judicial and non-judicial stamp paper.

Types of Stamp Papers

There are two types of stamp papers commonly used. They are:

01. Judicial stamp papers

02. Non-judicial stamp papers

01. Judicial Stamp Paper

Generally, judicial stamp papers are used for legal purposes. For instance, it can be used for proceeding with court cases or continuing legal procedures. These stamp papers are also known as court fee stamp papers as they are often used to avoid cash transactions with the court. A case may not be admitted by the court without the payment of court fees. This makes judicial stamp paper important.

02. Non-Judicial Stamp Paper

Non-judicial stamp papers are generally used for documents like Power of Attorney, sale deed, rent agreement, affidavits, transfer of immovable property like building or land, loan security, and mortgage or other important agreements.

The stamps are used as per the rates determined by the government for recovery of the stamp duty. At present, you can use a non-judicial stamp paper of value Rs.5, Rs.10, Rs.20, Rs.50, Rs.100, Rs.500, Rs.1000, Rs.5000, Rs.10000, Rs.15000, Rs.20000, or Rs.25000 for the documents mentions above.

Stamp Duty is the tax levied on the legal acknowledgment of documents. According to the law, it is mandatory to pay stamp duty to the Central/State Government when certain transactions take place. The value of stamp duty is either fixed or it may vary with the value of property/instrument under question. All states have different laws and prescribe the amount of stamp duty to be paid for a particular transaction which will vary from one state to another. In India, for instance, the Indian Stamp Act, 1899, is applicable for states, which do not have their own Stamp Act.

When paying the stamp duty, remember to research the required amount to be paid for a certain transaction. Avoid buying a non-judicial stamp paper or stamps or applying for franking or E-stamping without ascertaining the leviable dues, failing which you may overpay or pay less and remain liable for a penalty.

Uses of Stamp Paper

Judicial and non-judicial stamp papers have been in use in many countries. However, lately, electronic versions (E-Stamp paper) are being developed in order to increase ease of doing business and also to reduce the risk of fraud. We will see more about E-Stamp papers further in this article.

The stamp papers are an important source of income for many developing countries. In some countries, it’s difficult to collect direct taxes. That’s where stamp duty is a good source of revenue. Bangladesh is one such country that collects a large sum of tax revenue from stamp duty.

Stamp papers have also been widely used to collect taxes on various documents. The papers are always bought blank from licensed stamp vendors, post offices, Government Treasury offices, and courts. The concerned persons then write their mutual terms of the contract on the paper and lodge it with the court or concerned authority for legal validation.

This is an efficient and legal way of collecting taxes people owe to the government. It is also a passive way to get stamping documents legalized and authenticated without the obligation of submitting them to a responsible and authorized government authority.

How to Buy Stamp Papers?

There are three different ways of paying stamp duty or fulfilling the formality of buying stamp papers for paying scheduled stamp revenue. These are:

01. Buying Stamp Papers

a) Traditional Stamp Papers

b) E-Stamp Papers

02. Franking

03. Adhesive Stamps

In all these ways, you can pay stamp duty to the government to make a document legally enforceable. These days, E-stamp papers are proving to be an effective alternative to the traditional stamp papers. E-stamping is a computer-based arrangement that offers a secure way of paying non-judicial stamp duty to the government. The electronic non-judicial stamp paper bears a unique Identification Number that authenticates every transaction done on these papers.

The value of a stamp is to be used in the prescribed format under the instruction of law and will vary depending on the sale/deed value of the transaction. If you fail to pay attention to these details, the document may not remain enforceable. In other words, it will either become invalid or you may have to pay a penalty under the stamp act.

The Stamp papers have to be purchased in the name of one of the parties involved in the contract/transaction.

It is also advisable to buy judicial and non-judicial stamp papers from Government-authorized stamp vendors.

With regard to the non-postal stamp types and its use as stated herein, there are different types of stamps and dealings stated against it.

Non-Judicial Stamp Paper

01. E-Stamp Papers and Traditional Stamp Papers

Non-judicial stamp papers in India are avaiable as E-Stamp papers and traditional stamp papers. E-Stamps are available in certain banks and co-operative societies only. Buy a non-judicial E-stamp to write the contract/agreement on it.

E-Stamping:

The State Government of all states is introducing the facility of ‘E-Stamping’ through the Stock Holding Corporation of India Ltd. Mostly, this facility is available in all the districts and Block Head Quarters of the Sub-Registrar. Hence, the person going for registration of the document can opt for paying the duty at the site after which the E-stamping certificate is issued immediately.

Details You May Need While Buying a Non-Judicial Stamp Paper:

- First Party Name

- Second Party Name

- Addresses of both the parties

- Document Name

- Stamp Paper Value

Details Included on the E-Stamp Paper:

- Certificate no.

- Certificate issued date

- Account reference

- Unique Doc Reference

- Name of the E-stamp purchaser

- Description of document

- Description

- Consideration price

- Name of the First Party

- Name of the Second Party

- Name of the Stamp Duty Payer

- The value of stamp duty paid

02. Franking

Franking is a technique of printing a mark on a document indicating that the stamp duty for the transaction is already paid. Franking machines are installed in many Sub-Registrar offices. After the receipt of the stamp duty, the authorized officer franks the document and returns it to the applicant, authorizing the receipt of the money.

You may not have the availability of a franking facility nearby for validating your document because it is not widely available yet. However, you can always buy a traditional non-judicial stamp paper for remitting the stamp duty.

Moreover, if there is any demand for the same by the banks, special adhesive stamps franking licenses are available. These stamps have already earned huge popularity in the state of Gujarat and many others.

03. Adhesive Stamps

Adhesive stamps are convenient labels that can be pasted on documents as a sign that the stamp duty has already been paid. They are adhesive stamps like postal stamps but cannot be used on legal documents. Hence, avoid using them rampantly, unless you are sure about their acceptance.

The Easy Way to Get Stamp Papers:

Non-judicial stamp papers can be purchased online. Vendors also can provide you stamp papers of the following valued in bulk.

Rs.1 | Rs.2 | Rs.5 | Rs.10 | Rs.20 | Rs.50 | Rs.100 | Rs.500 | Rs.1000 and Rs.5000.

(a) Notary Stamps:

Before making the use of an affidavit, documents like the Power of Attorney have to be notarized by the Executive Magistrate or by a government-appointed Notary. Notarial stamps of Rs. 5/- value should also be used. This value may change from time to time.

(b) Revenue Stamps:

All over the nation, transactions of more than Rs. 5000/- need to be signed on Revenue Stamp. The revenue stamp of Rs. 1 value is available. The Revenue Stamps are available at Post-Offices.

(c) Agreement Stamps:

At the time of marriage registration or for all other agreements, stamps stated by the government have to be affixed and recovered.

(d) Insurance Stamps:

The Insurance Companies sell the policy on which the insurance stamp is used. Insurance stamps are available for the values like, Rs.1 | Rs.2 | Rs.5 | Rs.10 | Rs.20 | Rs.50 | Rs.100 | Rs.500 | Rs.1000.

(e) Share Transfer Stamps:

These are used at the time of sale or purchase of shares. The share transfer stamps values that are widely available are Rs.1 | Rs.2 | Rs.5 | Rs.10 | Rs.50 | Rs.100 and Rs.200.

(f) Foreign Bill Stamps:

At the time of execution of dealings between private and foreign firms, Foreign Bill Stamps are necessary. The said stamps of value – Rs.1 | Rs.2 | Rs.5 | Rs.10 | Rs.50 and Rs.100 are available for purchase.

In the previous times in the promissory notes the Hundi papers were used. In place of old Hundi papers nowadays special adhesive stamps are used. Hundi papers of value

Rs.1 | Rs.1.50 | Rs.2.50 | Rs.4 | Rs.5 and Rs.10 are available.

(g) Hundi Papers:

In the past, the Hundi papers were used in the promissory notes. Now, instead of the old Hundi papers, special adhesive stamps are used. Hundi papers of value – Rs.1 | Rs.1.50 | Rs.2.50 | Rs.4 | Rs.5 and Rs.10 are available.

(h) Judicial Stamp Paper:

During proceedings in the courts of law, the court fees are paid using the stamp paper. They are therefore called court fee stamps. Court fees stamp paper of Rs.50 | Rs.100 | Rs.200 | Rs.300 | Rs.500 | Rs.1000 | Rs.3000 | Rs.5000 and Rs.25000 are available for purchase.

(i) Court Fees Stamp Label:

These are affixing stamp used before the Court and Collector and the additional Collector. The said stamps of value are – 0.25 paise | 0.50 paise | Rs.1 | Rs.2 | Rs.3 | Rs.4 | Rs.5 | Rs.10 and Rs.20, respectively.

The Validity of the Stamp Paper

Section 54 of the Indian Stamp Act states that if you do not need a stamp paper bought by you, it can be deposited back to the Collector within six months from the date of purchase. In such cases, you will get a refund of the purchase value after deducting 10 percent of the amount.

In Thiruvengada Pillai Vs. Navaneethammal & Anr, it was held by the Hon’ble Supreme Court that a stamp paper, even if it is more than six months old, is valid for the use. Section 54 bars taking a refund after six months of purchase; however, it does not restrict the use of such old stamp paper for an agreement.

Thus, the stamp paper can be used even after it has crossed the stipulated validity period of its purchase.

As such, Indian law does not have any prescribed period of limitation for its validity. However, Maharashtra and Gujarat are the two states which have amended laws and now have law provisions stating that if a stamp is not used or surrendered within a time frame of six months from the date of issuing these papers, they will be treated as expired.

What to Do with an Old Stamp Paper?

As stated above, you can always deposit back the purchased stamp paper within six months from the date of purchasing the stamp paper, provided it’s not be spoiled or rendered unfit.

In such a situation, you will have to satisfy the below-mentioned conditions –

- You have purchased them for use with a bonafide intention.

- You have paid the full price of the stamp.

- The stamp paper was purchased within six months before the date of depositing.

- If you are a stamp vendor, you may get a 100% refund.

Future Plans of Government

According to the Business Standard newspaper, the Finance Ministry of India is planning to amend the Indian Stamp Act, in which stamp papers will come with a strict validity of one year. The purpose of such an amendment is to stop the misuse of stamp papers by preventing people from buying backdated papers to stake their claims on property in the future, even when no deal had happened on such date.

In addition to this, the electronic payment of stamp duty is proposed under the new bill to limit such issues.

In conclusion, it is mandatory to use stamp paper while you are legalizing an agreement or you are about to make a declaration. By using a stamp paper, your document will have legal validity and it can be enforced under the laws of the land.

Depending upon the type of the document, you have to choose between judicial and non-judicial stamp paper. You also always have the option of buying traditional stamp paper or opting for the E-stamping or franking process.

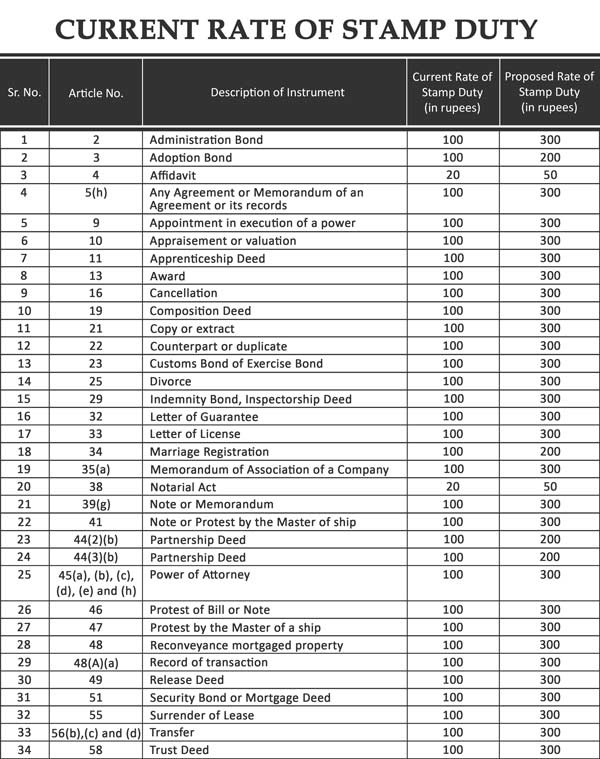

Current Rate of Stamp Duty

Here, we give the value of stamp required for different documents as per recent amendments in the Gujarat stamp authority. Every state has a different rule hence readers are advised to contact an advocate or the office of stamp registrar.

If stamps of such value are not available, you can also take resources to franking.

The Government of Gujarat Has Ended the Use of Physical Stamp Paper

In order to encourage the use of Digital stamping in lieu of non-judicial physical stamp papers, the Govt. of Gujarat has banned the use of physical stamp paper effective 1st October 2019.According to Govt. of Gujarat, this decision was made to promote the idea of ‘Digital India’ by our Hon’ble Prime Minister, Shri Narendra Modi.

Hence, all citizens will now have to use the facility of Digital stamping only. The facilities for e-stamping shall be available at all Scheduled banks and financial institutions under the control of State and Central Government, post offices, Licensee stamp vendors, Chartered Accountants, Company Secretaries, C&F agents of Ports, Common Service sectors under e-governance plan, Non-banking financial companies registered under RBI, and Licensee notaries among others.

According to the Government, this decision will effectively tackle issues like the artificial scarcity of stamp papers and reduce the risk of people being cheated by stamp vendors. Payments for stamp duty can be made in cash, through RTGS or net banking, or using other online payment facilities. The Government intends to start e-stamping facility centers all across the states.

The Digital stamping facility generates a ‘unique certificate number’ that can be verified during the registration of documents by sub-registrar, making the process secure. Further, being online, the registration can be verified at any time. Besides, the process offers freedom from buying blank stamp papers in advance, averting the need for applying for a refund of a stamp.