Home Loan is a sum of money borrowed from a financial institution or governmental as well as private banks to purchase a house. There is a general belief that home loans are only available for the purchase of homes. It is not so. There are various types of home loan provided for home construction, extension, plots of lands, and renovation of house. Home Loans are provided by many banking and non-banking financial companies in India. But before taking any decision, you must clearly know the types of home loan and which type might be suitable for you based upon your need.Needs may vary from person to person; some would want to buy an apartment while some would want to construct a house, some would want to buy a plot of land for building, while some just want to extend the house limits due to the increasing number of members in the family.

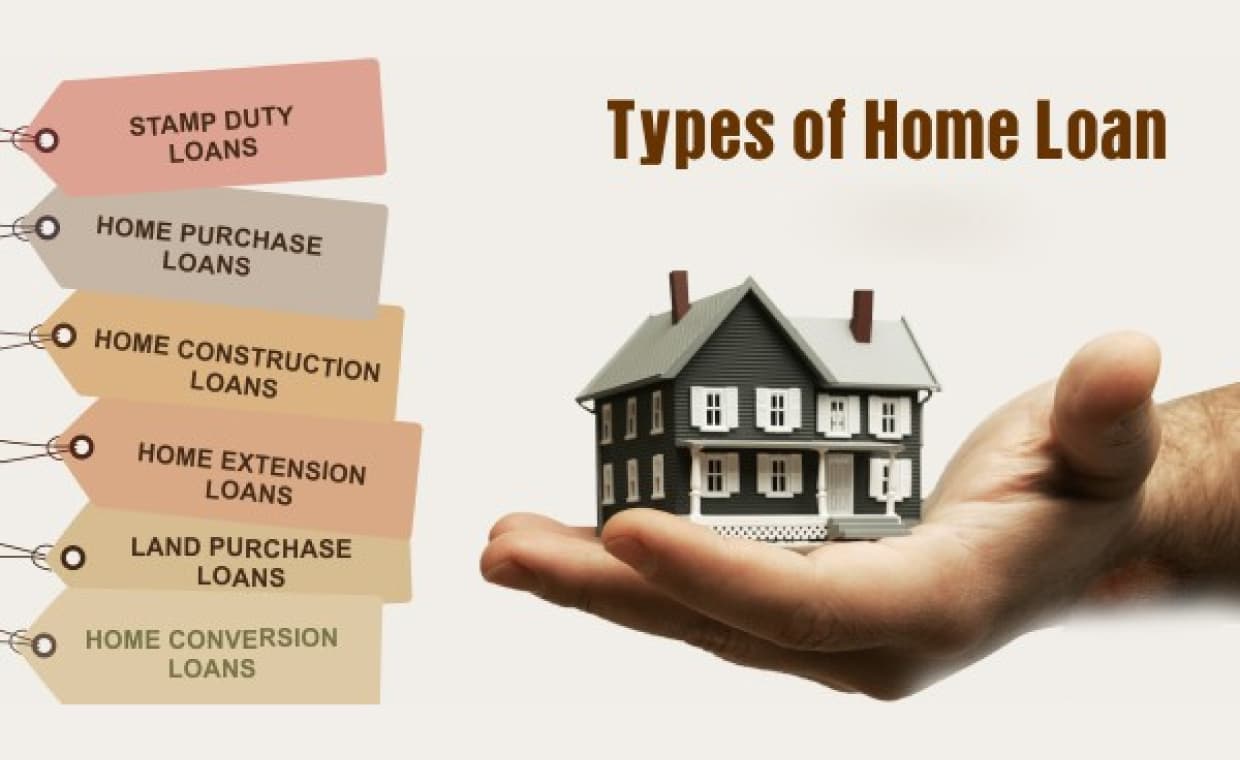

Listed below are various Types of Home Loan with their description:

Types of Home Loans

01. Home Purchase Loan

- From various types of home loan available, this is the most basic form of loan which is provided if you want to buy an apartment or an already constructed house.

- It also includes bungalow and row-house which are available for purchase directly from the developer or developing entity, and it also includes houses constructed on a plot of land.

- The banks have a loan to value (LTV) rate of about 80-85%. This means that the banks will only provide finance equal to 80% or 85% (for some banks 90%) of the market value of the building that is to be purchased.

- You will still have to set aside some amount for buying a house as banks will not provide amount for 100% of the building. This remaining 10-15% amount is called Margin Money or Down Payment.

- The interest rate for these types of loans that are provided averages around 9% (which varies from bank to bank).

- In India, at present the interest rate varies from 9% to 12%. It is around 4% to 6% in US and may be more in other countries where inflation rate is higher.

02. Plot Purchase Loan

- For people who want to buy land, it is necessary to invest in a residential plot of land.

- The customers who want to buy new residential plots for home construction and are inefficient to buy due to lack of money, banks provide these types of home loan.

- These plot loans are available for customers, who want to construct new houses, but not for agricultural purposes.

- There is also another option of having plot loans and home construction loans together so that all your expenses are covered. Only some banks provide this option.

- Plot purchase loans have a comparatively lower LTV (Loan to Value) ratio than home purchase loans. The finance provided is only about 70% of the market value of the property on average.

- The banks also have a low capacity of giving loans for plots so you will have to set aside a higher amount of your own money compared to home purchase loans. The interest rate is around 9% for plot purchase loans.

03. Home Construction Loan

- These types of home loan are provided by the financial Institutions to the applicants who want to construct a house on a plot of land.

- The details and requirements are different from those of standard home loans.

- These home loans are only given to those applicants who have purchased the plot of land within a year.

- Home Construction Loans are not given through the lump-sum method but through the installment method.

- In this method, loans are given as per the construction progress of the house. For some banks, the first installment is only given after the construction of the foundation and lintel layer of the house is completed.

- These types of home loan are only given for the solid foundations and do not include the interior works of the house such as painting, furnishing, decoration, plumbing services, lighting, etc.

04. Home Improvement Loan

- Home Improvement or Renovation Loans are given to those homeowners who have a house but do not have the required funds to improve or renovate their houses.

- These loans are given by many banks for the purpose of renovation. Proof will be required to be given to the banks that the money was spent on the house or that it was given to a contractor.

- The renovation includes – repairs to the existing house, painting of the walls, digging a bore well, waterproofing, electrical wiring, etc.

- The interest rate for home improvement loans is 9% to 10%.

05. Home Extension Loan

- These types of home loans are provided for the purpose of extending or expanding the house. When your needs increase or the size of your family increases there is a need for a larger house. If you do not have the required amount of funds you can take a Home Extension loan for expanding or constructing a new floor for your house.

- Only a few banks differentiate Home extension Loans from Home Improvement Loans as some banks include both extension and renovation to Home Improvement Loan.

06. Short-Term Bridge Loan

- Most of us sell our existing homes to buy new homes so that there is a sufficient amount of funds to make the transfer from one house to the other.

- But there will be some instances where you find the perfect home for your needs but you have to buy it right away to ensure that the house will be yours.

- The only problem you face at that instance is that there is a lack of sufficient funds to make that purchase and you are unable to arrange to sell the house.

- At that moment, you can take a short term bridge loan, so that you can purchase the house while you wait for yours to sell.

- These types of home loan are normally for short term for about 12 months.

07. Rural Housing Finance

- Home loans can also be given to individuals who want to purchase a new house in rural areas or semi-urban areas. These loans are called rural housing finance or rural home loans.

- They are like normal loans but their eligibility and amount are calculated by the agricultural land one owns and also the type of crop which it yields.

- There are also loans which are given benefits of rural development schemes by the government for housing in rural areas.

08. Balance Transfer Loan

- Many Financial Institutions and banks provide an option for transferring your home loan.

- When you are unsatisfied with your current interest rate of a bank or the services that it provides, you can transfer your home loan to another bank which provides lower interest rates and better facilities.

09. NRI Home Loan

- Home Loans are also available for the non-resident Indians who live abroad and can assist them if they want to buy a new house, or move into India.

- Though the advantages and facilities are the same as regular home loans, the requirement of paperwork is huge and its eligibility may also differ.

- These types of home loan charges higher interest rate and their tenure is lower than standard home loan.

10. Stamp Duty Loan

- This kind of loan is provided for payment of the stamp duty.

Hope this article would have informed you regarding basic knowledge about various types of home loan and their details. If you think that some points are missed out or you know about this topic then you can share it with us by commenting in the box given below.

Image Courtesy: Image 1, Image 2, Image 4, Image 5 – iflhousingfinance, Image 7, Image 8, Image 9 – dealsofloan

Author Bio

Savan Dhameliya