“Wise men live in the homes build by the foolish”. This old saying has many believers among millennial particularly when the prices of the houses and their EMI are going beyond the reach of many. There are ongoing debates and different views on whether it is feasible to pay rent or EMI i.e. to buy an abode or stay in a rented place for lifetime. By and large the views and opinions are in the favour of paying EMI and owning a house rather than paying rent. Yet such views and opinions cannot be generalized as this is completely a personal affair which can differ from an individual to individual and situation to situation. This is also because people have different life circumstances, thoughts and beliefs. Both the schools of thoughts have their strong arguments and favouring views to prove themselves better than the other. Thus, this makes it difficult for a common man to arrive at a decision.

Enjoying Future Income

Purchasing something on a long term loan i.e. borrowed money that is paid off over an extended time frame, means you have the privilege of enjoying the ownership of an asset or a property from the day one itself out of the income which perhaps you are going to earn in the next coming 15/20 years or so. It means, though it is unaffordable for you at this moment, still you can start enjoying the property from today itself by paying an additional cost, that is – interest, and paying the rest of the amount through installments. So, now the question remains – how far is EMI/interest affordable and feasible to you as compared to the rent amount.

Of course while availing loan you also get the facility to pay the total amount of the loan in installments, which you will have to pay regularly in due course of time as per the agreement or a legal compulsion. However, if you do not avail loan, probably it might not be possible to save the amount every month to pay for EMI and you will spend/waste it one way or the other resulting in not owing anything at the end of 20 years. This stark reality cannot be ignored.

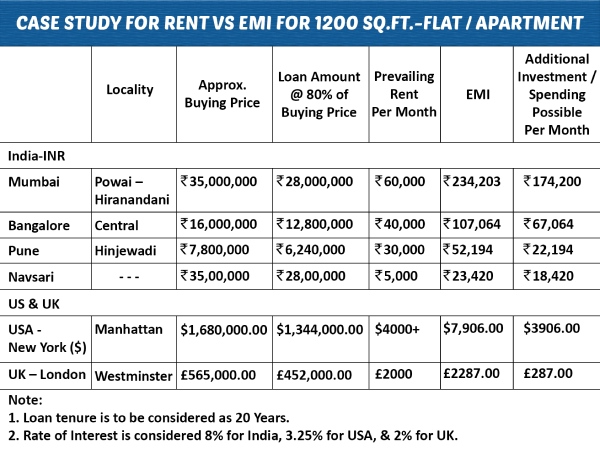

Real Life Examples to Understand Whether One Should Pay Rent or EMI

We have hereby mentioned 6 real life examples of various metros/cities in India, US and UK after studying prevailing house price as well as prevailing rent and rate of interest. The following table shows the comparison of Rent Vs EMI.

Take for instance Navsari – a small town in Gujarat, where GharPedia has it’s headquarter; the current price of a 1200 to 1300 sq.ft. 2/3 BHK flat is around Rs. 35.00 lac and if you consider monthly rent, maximum amount one can fetch around is Rs. 5000 to 6000/- only. Now, if you avail housing loan for 80% of the amount i.e. Rs. 28.00 lac for 20 years @ 8% rate of interest, you would end up paying EMI of Rs. 23,420/- per month. As per the bank’s norms and HDFC’s Home eligibility calculator, the loan of Rs. 28 lac is availed to someone whose monthly income is Rs. 50,000/- or more per month.

Why Pay EMI? Why not Invest?

Now, anybody will think that if you can stay in the same house by paying a rent of Rs. 5000/- pm, why pay additional Rs. 18,000/- every month for EMI? This thought immediately gives rise to some further ideas:

- Why should I not invest those additional Rs. 18,000/- in stock market/mutual fund etc., and gain more along with increasing worth of money.

- Why should I not spend those additional Rs. 18,000/- on my better lifestyle & enjoy, as that would increase my monthly spending capacity from Rs. 27,000/- to Rs. 45,000/-.

Alternatively, say for instance you already have a saving of Rs. 35.00 lac for purchasing the flat and you do not want to avail a housing loan. Now, if you invest this Rs. 35.00 lac in mutual funds or stocks instead of investing in purchasing a home; you may earn a return of Rs. 30,000/- to Rs. 35,000/- pm or perhaps more. So why not pay the rent of Rs. 5000/- and save the additional amount of Rs. 25,000/- to Rs. 30,000/- or invest them in some business or enjoy a better living.

Joy of Owning a Home

Let us look at this situation from another perspective. The Indians, especially the middle-class aims at owning a house of their own – “Apna Ghar” during their lifetime. There are more of sentiments and feelings attached with purchasing a home which matters apart from looking at it as a status symbol and as an investment. Hence considering that sentiment, one will not even hesitate to pay a good amount of EMI for longer period of time if that assures him/her the “Joy of owning a home”.

Though the financial savings seems lucrative and enticing when one opts for a rented house, then why people buy house paying hefty EMI? Why would they do so! Then, mentioned below are the obvious advantages of owning a home:

7 Benefits of Owning a Home

01. It gives you a sense of satisfaction and peace of mind. And, nothing can be valuable ever than this.

02. It is your home, you own it legally hence nobody can ask you to vacate your place. Nobody can move you out of the house under any given circumstances.

03. Owning a home will never keep you worried even if you lose a job for some reason or you are going through thick and thin in your business. Owning a home will ensure shelter so that you can survive at least.

04. Under some odd circumstances, you can even mortgage your home and borrow money for investing in business or for medical emergencies or children’s education, marriage etc.

05. During old age when you run out of income and earnings, owning a home will take off your worry of paying rents. Remember, at that age you should either be able to pay rent or own a house, or else old age homes i.e. वृद्धाश्रम will be shelter for you which can perhaps be shocking, depressing and frustrating for you.

06. Normally the real estate rates keeps on increasing. Thus, the valuation of your asset will also keep rising.

07. Let us assume that considering several other factors you decide to postpone buying a house for now. But later in future if you decide to buy a house, it is going to be obvious that the EMI may sharply rise with the rise in the rate of property. So, this must be kept in mind while going for a rented house.

Basically the decision will be governed by various factors, which can be broadly classified into four main categories. Hence, if you are in a dilemma whether to pay rent or EMI, the following explanation will help you to take a call.

4 Major Factors that Governs the Decision of Buying a Home are

01) Professional

02) Financial

03) Physical

04) Personal and Social

01) Professional Factors

● Your Chances of Settling Permanently in a City

One thing you must understand is that you cannot buy a house every now & then. The process of buying and particularly selling a house is time consuming and tedious. So never buy a house unless you are sure that you are going to stay at that particular town/city place for a long time or permanently. If your job/business is such that you will have to keep moving from one city to another, purchasing a house may not be a wise decision. Many people wish to go back to their native or birthplace after long years of services or after retirement. In that case, it makes sense to buy something at your native place and not where you do job.

● How Long You are Going to Stay at a Place?

Unless you are going to stay for a long duration in a particular town, buying a house there would not be a good decision. This is because if you move to another city, you cannot buy a house immediately as you might not have that much cash on hand, or you might not be able to sell the first one immediately. In this case, you will continue to pay EMI on the first house and rent for the second house.

● Loans are Long Term

The tenure of any home loan is not for a year or two but it is for a long duration that extends up to 20/30 years. Therefore, you should be confident about your job, about its stability for the next 20 years so that you shall be in a comfortable position to make regular repayment of the loan through EMI. Say for instance, during this repayment period if you lose your job or have odd days in business, you will be hardly given a relief of three months by the banks. It will therefore be a big concern if you remain unemployed for a longer time. Banks may initiate legal proceedings against you.

● Thus, if and only if you are sure about the stability of your job/business and rise in salary/income in the future, you should opt for EMI or else renting a house is a better choice in such cases.

02) Financial Factors

● The foremost important factor for deciding whether to rent a house or buy is your current financial condition. If you want to purchase a house, calculate all the costs related to buying a house i.e. stamp duty, cost of moving etc., and arrive at a net total. If the proposed EMI is less than or between 33 to 40% of your monthly income, you should go ahead for buying the property rather than take it on rent.

● Let us understand this concept properly with an example. Say for example, you earn Rs. 1.00 lac every month. Now, if you apply for home loan, you may be entitled for a home loan of Rs. 40 lac to 50 lac for the tenure of around 20 years. Now check out for your monthly expenses. Deduct the EMI from your monthly earnings. If the monthly expenses are lesser than this amount which means you still have surplus amount remaining every month, which can be used in case of any future needs or in case of emergency. If this is how it works out, then you should consider buying a house. Otherwise it is a better to go for a rented one.

● If the percentage of EMI is more than 40% of your monthly income, it is better to opt for renting rather than buying.

● Your Current Family Income and Your Capacity to Buy

When you want to avail a home loan, your current family income is very important. Normally you get 40 to 50 times of your monthly income as a housing loan. Thus, it will decide your purchasing capacity and the amount of EMI you will have to pay per month.

If you are living in India and you are thinking of buying a home through Home Loan; please do not forget to read the article on “Types of home loan available in India”.

● Prevailing Real Estate Rates

Whatever might be your income, but the prevailing real estate rates are very important. Though in the same city, the rates may vary from place to place. You might not afford to buy a house in a posh area or a preferred locality; and at the same time you may not prefer or want to live, where you can afford it.

● Prevailing House Rents

Similarly, prevailing rental rates are equally important. This is a criterion which is governed by the demand and supply of rental housing and people in demand for rental housing.

● Rates of Interest for Home Loan & Tax Incentives

This is more important during inflationary trends, when rate of interest is high. Ultimately you have to decide whether you can afford to pay interest for a long duration or not.

● Affordability of Upfront Payment/Down Payment

- The loans provided by banks cover only 80% to 90% of the total property cost. The remaining 10% to 20% needs to be arranged by the borrower. Hence, for the purchase of home, 20 to 30% is the upfront/down payment you need to arrange for or you must have that much amount free of liability ready with you.

- If this amount is ready with you, then only buying of house is possible.

03) Physical Factors

● Location in a City Where You Want to Buy

- As mentioned earlier, the location where you want to buy is very important apart from being affordable. It must be near your workplace, your wife’s workplace and most importantly, it should be convenient in commuting for your school going kids.

- Supply & demand and stock of housing available in the locality will decide the price. Buying might be affordable if stock of “For Sale House” is more, and vice versa. Similarly, Renting would be a better option if stock of “For Rent House” is more.

● Taxes and Repairs & Maintenance of an Owned Home

- When you purchase a house, you are also purchasing all the headaches associated with the repair and maintenance of that house for its lifetime. Thus, in order to keep your property in good shape, you will have to have some minimum earnings otherwise its value will deplete.

● Taxes

- Similarly, you will have to pay all sorts of taxes like property tax, water charges etc., to the local government. These are all the additional expenses one needs to bear along with a handsome EMI.

04) Personal and Social Factors

● Your Age

If you are young, not only that you can take the risk, but chances of rise in your income are high. Bank will always prefer financing the younger category.

● Are You a Single or With Family

If you are single, it is easy for you to move from one house to another. But if you have a family, it will be difficult to move from one place to another that often. You may never prefer your family to suffer due to “oft and on moving”.

● Social Consideration

Owning a house holds a ‘Status’ in the society. It is a status symbol. It also satisfies your ego and keeps you happy all the time.

● Peace of Mind

“Peace of mind” is something invaluable and beyond words. We humans strive for the peace of mind throughout our lives. Owning a house not only satisfies your ego but gives you a sense of satisfaction and most importantly peace of mind.

● Marriage of Children

When we talk about Indian society, one of the criteria while selecting a bridegroom for the daughter depends on the fact whether the “would be bridegroom” or his family owns a house or no? If he or his family owns a home, it ensures some sense of security to the parents of the bride and they go ahead affirmatively. The westerners might find this little odd but this is how Indian society works. Owning a house is a sign of prosperity amongst Indians.

Conclusion

It is thus a very personal decision whether to pay Rent or EMI. As mentioned above, our decision regarding the same is influenced and dependent upon various factors such as financial conditions, income stability etc. The cash which we pay for buying the asset helps us in building an abode which is a symbol of peace, security and lifetime achievement.

Keep in mind that buying a home means investing a large amount of earnings on an asset that you own legally. However, putting in a high percentage of your income might result in banks benefiting themselves more from the interest you pay for buying the home instead of increasing the benefit of your financial investment. You will be stuck in a financial rut for a long time if you end up investing more than your capacity.

Hope this article on Rent Vs EMI helps you in making an appropriate decision whether to pay rent or EMI.

Image Courtesy: Image 7, Image 8, Image 9, Image 10, Image 11, Image 12, Image 13, Image 14