Write for Gharpedia

You can be a part of our blogging community, write blogs and do much more. All you need is an account

Bedroom Calculator

This calculation is based on few limited inputs only. The exact cost will vary to the extent of plus or minus 10% to 15%. It has been workout on the following assumption which will vary from case to case. For 100% accuracy one need to workout details through expert professional after having detailed drawing and […]

This calculation is based on few limited inputs only. The exact cost will vary to the extent of plus or minus 10% to 15%. It has been workout on the following assumption which will vary from case to case. For 100% accuracy one need to workout details through expert professional after having detailed drawing and design.

The five categories assumed here are very general in nature and the classification may vary from person to person based on individual choices and life style.

The above classification is to give an idea about the range of prices based on range of materials, brands, available in the market.

The break-up of all major components into Materials and Labour has been given, so that the user can budget or can negotiate with the contractor accordingly.

The overhead cost, contractor’s profit & GST has been counted at 10%, 15% and 14% respectively. This will be applicable on materials cost also. Hence the — labour amount would be around 35% to 50% cost shown as total of Labour + overhead + contractor profit + GST.

Estimate is based on the current prevailing market rates.

The cost does Not Include:

- Any RCC Slab, beam etc. brickwork, plaster as required for a bedroom

More Calculators

Carpet Cost Calculator

Goblet Pleat Curtain Calculator

Tab Top Curtain Calculator

Wave Curtain Calculator

Rod Pocket Curtain Calculator

Triple Pleat Curtain Calculator

Flat Curtain Calculator

Eyelet (Grommet) Curtain Cost Calculator

Semi Circular Staircase Calculator

Spiral Staircase Calculator

Dog Legged Staircase Calculator

Straight Staircase Cost Calculator

Cantilever Staircase Calculator

Aluminum Sliding Gate Calculator

Wood Calculator for Window

External Plaster Calculator

Wood Calculator for Door

Internal Plaster Calculator

Foundation Cost Calculator

Bathroom Repair Cost Calculator

Staircase Railing Calculator

Steel Sliding Gate Calculator

Wooden Swing Gate Calculator

Aluminium Swing Gate Calculator

Steel Swing Gate Calculator

Flooring Cost Calculator

Study Room Calculator

Children Bedroom Calculator

Covering Balcony Calculator

Pooja Room Calculator

Bedroom Calculator

Living Room Interior Calculator

Living Room Furniture Calculator

Dining Room Interior Calculator

Dining Room Furniture

Kitchen Appliances Calculator

Kitchen Island Calculator

Kitchen Interior Calculator

Kitchen Platform Calculator

Bathroom Cost Calculator

Borewell Cost Calculator

Earth Filling Cost Calculator

Compound Wall Cost Calculator

Calculator Info

Category: LowEconomicMediumLuxuriousUltra Luxurious

Calculator Inputs

Length of Bedroom (A)

Width of Bedroom (B)

Assumptions

- Low

- Flooring Tiles

- Vitrified Tiles – 300 mm X 300 mm

- Vitrified Skirting

- Paint

White or colour wash is considered

- Door – Window

- Wooden flush door with wooden frame

- Panelled window with wooden frame and M.S Grill

- Bedroom Furniture

Wooden bed – W x H x D: 189 cm x 95 cm x 206 cm

- Bedroom Furniture

Steel almirah

- Bedroom Furniture

Round shape wooden side table

- Bedroom Furniture

Cushion pillow

- Bedroom Decor Item

Bed linen

- Bedroom Decor Item

Polyester window curtain

- Bedroom Decor Item

Bonsai Artificial Plant with Pot

- Bedroom Decor Item

Wooden Photo Frame for 7 photos

- Bedroom Decor Item

Round shape wall clock

- Bedroom Decor Item

Round wall decorative mirror with MDF frame

- Bedroom Decor Item

Metal green leaf Ganesh god idol statue showpiece

- Bedroom Decor Item

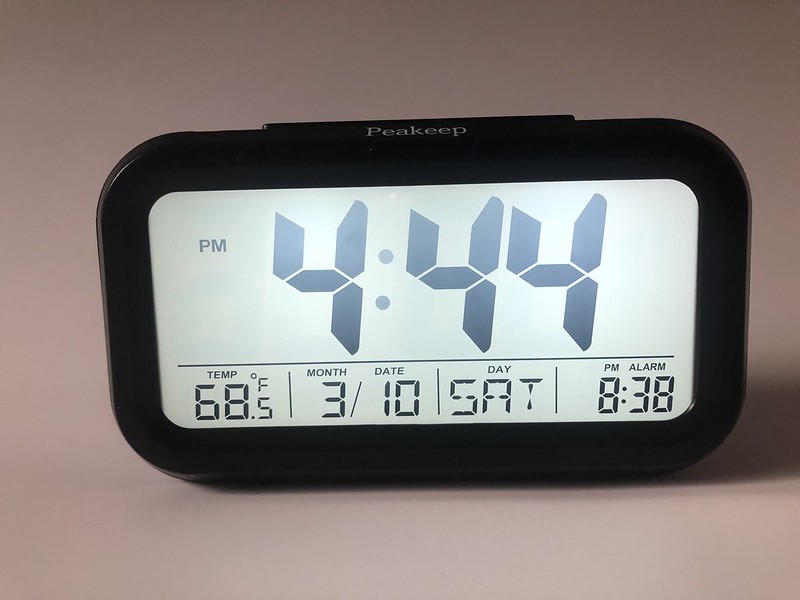

LED Alarm Clock including Calendar & Temperature desktop

- Misc

Mini LED flashlight with button

- Bedroom Electrical

24-inch HD Ready LED TV

- Bedroom Electrical

Wall lamp

- Bedroom Electrical

Ceiling fan

- Bedroom Electrical

Night lamp

- Bedroom Electrical

Lump sum electrical cost is considered (Switches, fan point, lights point)

- Economic

- Flooring Tiles

- Vitrified floor Tiles – 600 mm X 600 mm

- Vitrified Skirting

- Paint

Dry distemper with priming coat (Wall & ceiling)

- Door – Window

- Wooden flush door with wooden frame

- Panelled window with wooden frame and M.S Grill

- Bedroom Furniture

Wooden bed – W X H X D: 159.6 cm X 80 cm X 203.5 cm

- Bedroom Furniture

Steel almirah

- Bedroom Furniture

Solid wood square shaped side table

- Bedroom Furniture

Cushion pillow

- Bedroom Decor Item

Bed linen

- Bedroom Decor Item

Polyester window curtain

- Bedroom Decor Item

Alarm clock

- Bedroom Decor Item

Bonsai Artificial Plant with Pot

- Bedroom Decor Item

Portrait wall frame of bird between trees

- Bedroom Decor Item

Round shape wall clock

- Bedroom Decor Item

Round wall decorative mirror with MDF frame

- Bedroom Decor Item

Waiting Two Birds On A Tree Decorative Showpiece

- Misc

Flashlight torch

- Bedroom Electrical

Onida 60.9 cm (24 inch) HD Ready LED TV

- Bedroom Electrical

White Glass Wall Light

- Bedroom Electrical

Ceiling fan

- Bedroom Electrical

Night lamp

- Bedroom Electrical

Lump sum electrical cost is considered (Switches, fan point, lights point)

- Medium

- Flooring Tiles

- Vitrified Floor Tiles – 1000 mm X 1000 mm

- Vitrified Skirting

- Paint

Primer, wall putty & 1st quality acrylic distemper (Walls & Ceiling

- Door – Window

Wooden flush door with wooden frame

- Door – Window

Two track Aluminium glazed window with M.S. Grill

- Bedroom Furniture

Wooden Bed – W x H x D: 159.5 cm x 86.6 cm x 216.5 cm

- Bedroom Furniture

Wooden rectangular shape side table

- Bedroom Furniture

Engineered Wood 3 Door Wardrobe (Mirror Included) – Width x Height: 118.5 cm x 181.8 cm

- Bedroom Furniture

Engineered Wood study table /work table – D x W X H: 508 X 889 X 762 mm

- Bedroom Furniture

Engineered Wood Dressing Table – W x H x D: 120 mm x 1500 mm x 705 mm

- Bedroom Furniture

Wooden Contour Chair with Stool including fabric upholstery

- Bedroom FurnitureWooden Contour Chair with Stool including fabric upholstery

Metal Open Book Shelf – W x H x D: 152 cm x 144 cm x 31 cm (include 12 shelf)

- Bedroom Decor Item

Bed linen

- Bedroom Decor Item

Cotton window curtain

- Bedroom Decor Item

Plastic Artificial Topiary Ball Tree Decoration Plant

- Bedroom Decor Item

Alarm clock including LED display with Digital Therometer & Temperature

- Bedroom Decor Item

Multi-Colour Tree Modern Art Wall Painting with Frame – W x H: 20 inch x 30 inch

- Bedroom Decor Item

Large wall clock

- Bedroom Decor Item

Wrought Iron Wall Hanging Ganesha with basuri

- Bedroom Decor Item

Sunburst Multiple Mirror with Frame of steel

- Bedroom Decor Item

Waiting Two birds on a tree decorative showpiece

- Misc

Corded Landline Phone

- Misc

Flashlight torch

- Bedroom Electrical

Sony 59.9 cm (24 inches) HD Ready LED black colour TV

- Bedroom Electrical

White Jute Wall Light

- Bedroom Electrical

Ceiling fan

- Bedroom Electrical

1 Ton Split AC

- Bedroom Electrical

Contemporary Plug-In Night Lamp

- Bedroom Electrical

LED Desk Light Table Lamp

- Bedroom Electrical

Lump sum electrical cost is considered (Switches, fan point, lights point)

- Luxurious

- Flooring Tiles

- Vitrified Floor Tiles – 800 mm X 1600 mm

- Vitrified Skirting

- Paint

Primer, wall putty & Deluxe Multi surface paint (Walls & Ceiling)

- Door – Window

Wooden flush door with luxurious granite frame

- Door – Window

uPVC white colour casement cum fixed glazed windows with M.S. Grill

- Bedroom Furniture

Wooden Bed with Storage – W x H x D: 75.4 in x 36.4 in x D: 82 in & Seating Height – 15 in

- Bedroom Furniture

Rectangular plywood storage bed side table – W x D x H: 53 cm x 46 cm x 46 cm

- Bedroom Furniture

Engineered Wood 4 – Door Wardrobe

- Bedroom Furniture

Engineering wood study Table with Drawer – W x D x H: 36 in x 16 in x 29 in

- Bedroom Furniture

Engineered Wood Dressing Table – W x H x D: 800 mm x 1805 mm x 400 mm

- Bedroom Furniture

Upholstered bench to end of bed

- Bedroom Furniture

Chair

- Bedroom Furniture

Fabric Lounge chair

- Bedroom False Ceiling

Gypsum false ceiling

- Bedroom Decor Item

Bed linen

- Bedroom Decor Item

Cotton window curtain

- Bedroom Decor Item

New Upgraded 6.3″ Large LED Display Digital Alarm Clock with Big Number

- Bedroom Decor Item

Green Fabric Artificial Fiddle Leaf Bonsai Plant in a Ceramic Pot

- Bedroom Decor Item

Ganesha wall Paintings in multiple Frames – W x H: 36 inch x 24 inch

- Bedroom Decor Item

Peacock wall clock

- Bedroom Decor Item

Brass Statue Murti Sleeping Reclining Buddha Idol Home Decor Showpiece

- Bedroom Decor Item

Frameless decorative contemporary round wall mirror

- Bedroom Decor Item

Polyester Round Floor Cushion

- Bedroom Decor Item

Microfibre cushions

- Misc

Cordless Landline Phone

- Misc

Stainless steel – Pedal bin/ waste paper bin

- Misc

Folding hook

- Misc

Scent Diffuser

- Misc

Flashlight torch

- Bedroom Electrical

Samsung 108 cm (43 Inches) Series 5 Full HD LED TV

- Bedroom Electrical

Luxury Crystal Decor Wall Mount Lamp Light

- Bedroom Electrical

Ceiling fan includes 4 blades & 3 lampshades

- Bedroom Electrical

1.5 Ton 5 Star Split Inverter AC

- Bedroom Electrical

White Fabric Shade Floor Lamp with base

- Bedroom Electrical

Table lamp

- Bedroom Electrical

Clip-on Flexible Table Desk Lamp

- Bedroom Electrical

Acrylic LED Ceiling Light

- Bedroom Electrical

Night lamp

- Bedroom Electrical

Crystal chandellier – H: 19 in X W: 17

- Bedroom Electrical

Lump sum electrical cost is considered (Switches, fan point, lights point)

- Ultra Luxurious

- Flooring Tiles

- Vitrified Floor Tiles – 800 mm X 1600 mm

- Vitrified Skirting

- Paint

Primer, wall putty & Deluxe Multi surface paint (Walls & Ceiling)

- Door – Window

Wooden flush door with luxurious granite frame

- Door – Window

uPVC white colour casement tree track sliding window with fly proof SS wire mesh and M.S. Grill.

- Bedroom Furniture

Bed with Storage in Brown Colour – H 55.3 in x W 64.9 in x D 78.7 in & Seating height – 13.3

- Bedroom Furniture

Rectangular shape engineered Wood Bedside Table

- Bedroom Furniture

Engineering wood with melamine finish wardrobe – H 78.7 in x W 71 in x D 23.6 in

- Bedroom Furniture

Engineering wood Study Table /work table with Cabinet

- Bedroom Furniture

Solid Wood Dressing Table – W x H x D: 800 mm x 1800 mm x 460 mm

- Bedroom Furniture

Reclining chair & ottoman

- Bedroom Furniture

Teakwood Italian Diamond Studded Bench

- Bedroom Furniture

Shelf with hook

- Bedroom Furniture

1 Seater Recliner chair

- Bedroom False Ceiling

Gypsum false ceiling

- Bedroom Decor Item

Bed linen

- Bedroom Decor Item

Smart Clock (with Google Assistant) – 4″ IPS Touchscreen display

- Bedroom Decor Item

Cotton window curtain

- Bedroom Decor Item

Natural Looking Artificial Plants with pot

- Bedroom Decor Item

Multiple Frames Beautiful Buddha – W x H: 52 inch x 30 inch with water resistant

- Bedroom Decor Item

Circular shape Luxury Quartz Creative Large Wall Clock Art Golden Peacock Clocks

- Bedroom Decor Item

Buddhas big showpiece – 12 cm x 37 cm x 20 cm

- Bedroom Decor Item

Large wall mirror

- Bedroom Decor Item

Natural Straw Washable Tatami Cushion Floor

- Bedroom Decor Item

Cushions

- Bedroom Electrical

Sony Bravia 108 cm (43 Inches) Smart 4K HD LED TV

- Bedroom Electrical

Philips Wallchiere Wall Lamp

- Bedroom Electrical

2 Ton 5 Star Split Inverter AC

- Bedroom Electrical

Tripod Floor Lamp with base

- Bedroom Electrical

Table lamp

- Bedroom Electrical

LED Ceiling Pendant Dimming Ring Light chandelier

- Bedroom Electrical

Night lamp

- Bedroom Electrical

Rolf Desk Lamp

- Bedroom Electrical

Lump sum electrical cost is considered (Switches, fan point, lights point)

- Misc

Rechargeable 1200 Meter Long Range Torch light

- Misc

Cordless Landline Phone

- Misc

Cloud Mist Humidifier, Aroma Diffuser

- Misc

Fluffy Rugs

- Misc

Stainless steel – Touch top bin/waste paper bin

- Misc

Space Heater

- Misc

Ironing board

- Misc

Coat Hook

Related Blogs

I need help to

Explore Nearby Professionals

Engineering Consultant

452 professionals

Packer & Mover

410 professionals

Material Manufacturer

547 professionals

Vastu Consultant

251 professionals

Retailer

4152 professionals

Other

260 professionals

Labour contractor

23 professionals

Interior designer

1521 professionals

House cleaning

167 professionals

Are you searching for a house related professional / worker / supplier in your vicinity? Here is the list.

View All Nearby ProfessionalsWrite for Gharpedia

You can be a part of our blogging community, write blogs and do much more. All you need is an account.

Get In TouchBedroom Calculator

This calculation is based on few limited inputs only. The exact cost will vary to the extent of plus or minus 10% to 15%. It has been workout on the following assumption which will vary from case to case. For 100% accuracy one need to workout details through expert professional after having detailed drawing and […]

This calculation is based on few limited inputs only. The exact cost will vary to the extent of plus or minus 10% to 15%. It has been workout on the following assumption which will vary from case to case. For 100% accuracy one need to workout details through expert professional after having detailed drawing and design.

The five categories assumed here are very general in nature and the classification may vary from person to person based on individual choices and life style.

The above classification is to give an idea about the range of prices based on range of materials, brands, available in the market.

The break-up of all major components into Materials and Labour has been given, so that the user can budget or can negotiate with the contractor accordingly.

The overhead cost, contractor’s profit & GST has been counted at 10%, 15% and 14% respectively. This will be applicable on materials cost also. Hence the — labour amount would be around 35% to 50% cost shown as total of Labour + overhead + contractor profit + GST.

Estimate is based on the current prevailing market rates.

The cost does Not Include:

- Any RCC Slab, beam etc. brickwork, plaster as required for a bedroom